malaysia personal income tax rate 2019

The Personal Income Tax Rate in the United Kingdom stands at 45 percent. Assessment Year 2018-2019 Chargeable Income.

Individual Income Taxes Urban Institute

Thresholds in Canadian funds are.

. Income tax filing for sole proprietors is straightforward. And tax exemptions on house. Malaysia follows a progressive tax rate from 0 to 28.

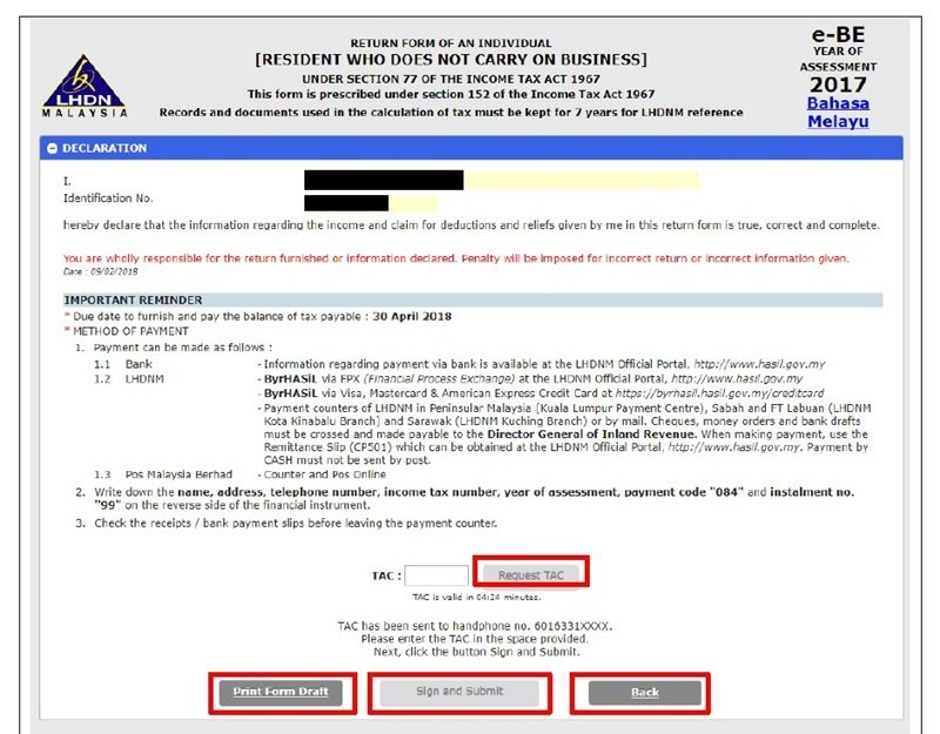

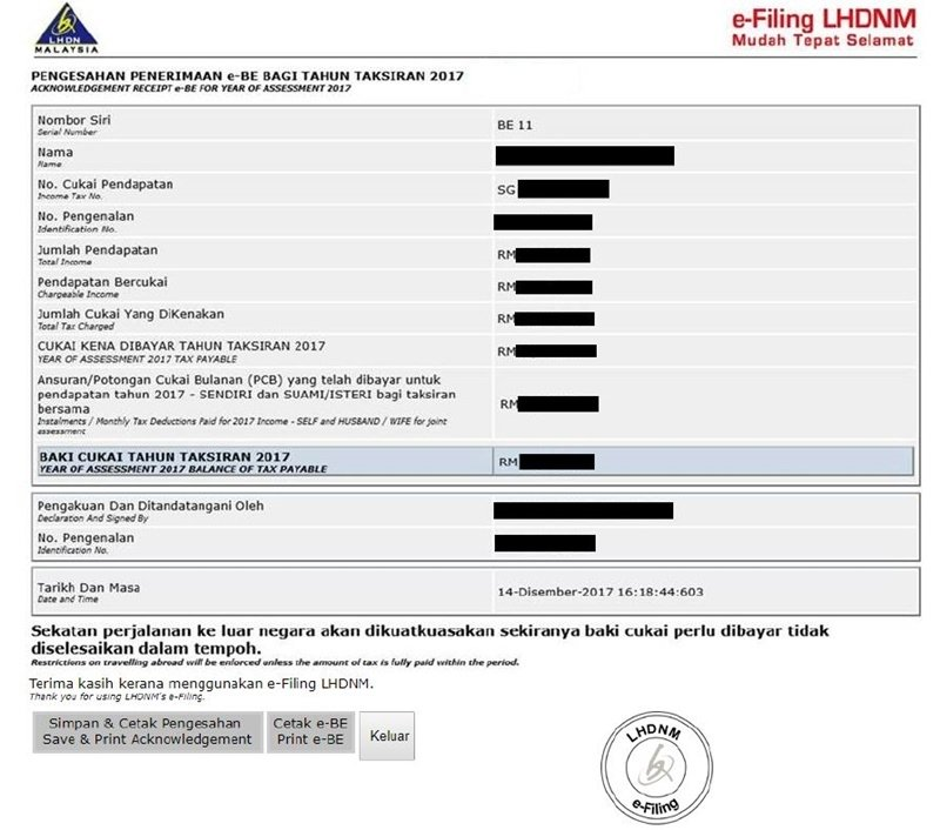

Instead of filing Form BE which is filed by individuals under employment or having non-business income sole proprietors file Form B before 30 June on a yearly basis. Yonhap news articles produced by building a network covering domestic supplies in various newspapers broadcasting and government departments major institutions major corporations media K-pop K-wave Hallyu Korean Wave Korean pop Korean pop culture Korean culture Korean idol Korean movies Internet media and international agreements of the Republic of. Inland Revenue Board of Malaysia shall not be liable for any loss or.

Bank of Baroda Indias International Bank offers Net Banking Services Personal banking services like Accounts Deposits Cards Loans Insurance more to meet your banking needs. Malaysia Personal Income Tax Guide. Malaysia Corporate Income Tax Rate for a company whether resident or not is assessable on income accrued in or derived from Malaysia.

An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. Personal Income Tax Rate in the United Kingdom averaged 4234 percent from 1990 until 2021 reaching an all time high of 50 percent in 2010 and a record low of 40 percent in 1991. 79054 for the 2020 tax year.

The Personal Income Tax Rate in Sweden stands at 52 percent. Surcharge P90000 x 25 tax rate P240000. Income Institution.

Applies only if your net world income is more than the threshold for the tax year. 79845 for the 2021 tax year. Gross domestic product GDP is the market value of all final goods and services from a nation in a given year.

Other income is taxed at a rate of 30. 75910 for the 2018. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields.

In Malaysia for a period of less than 182 days during the year but that period is linked to a period of physical presence of 182 or more consecutive days in the following or preceding. 115-97 permanently reduced the 35 CIT rate on resident corporations to a flat 21 rate for tax years beginning after 31 December 2017. In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable.

Non-residents are subject to withholding taxes on certain types of income. Till FY 2019-20 there was only one tax regime with four tax slabs and tax rates. Calculations RM Rate TaxRM 0 - 5000.

Vehicle insurance may additionally. US tax reform legislation enacted on 22 December 2017 PL. Upon receipt and verification including matching current taxpayer and taxpayer representative records with the information on the submitted Form 4506-T a copy of the original.

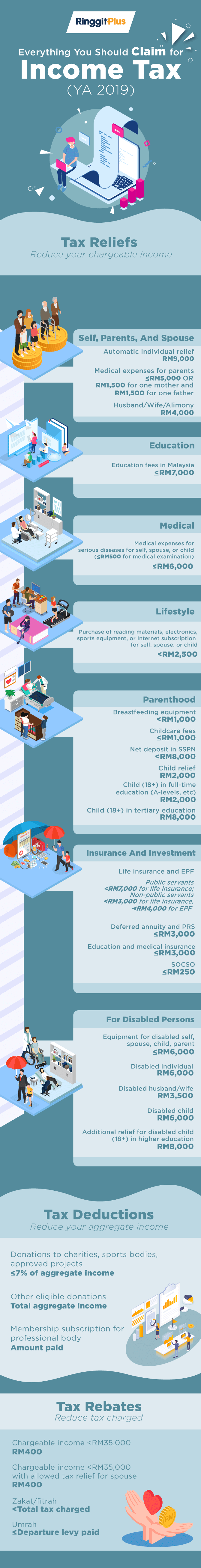

The IRS will provide a copy of a gift tax return when Form 4506 Request for Copy of Tax Return is properly completed and submitted with substantiation and payment. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. Check Income Tax Slabs Tax Rates in india for FY 2021-22 AY 2023-24 on ET Wealth.

Further to bring down the gross total income an individual was allowed to claim deductions under sections like 80C 80D etc. View flipping ebook version of 475929704-Income-Tax-2019-Banggawan-SolMan-pdf published by busaingchristina001 on 2020-10-02. No other taxes are imposed on income from petroleum operations.

Small and medium enterprises SMEs that conduct business in Sri Lanka which do not have an associate that is an entity and with an annual turnover. Calculations RM Rate TaxRM A. This page provides - Sweden Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news.

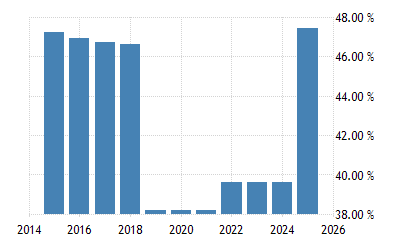

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. The stress-test rate consistently increased until its peak of 534 in May 2018 and it was not changed until July 2019 in which for the first time in. Income Tax Slab for Financial Year 2019-20.

This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. Is an additional tax that is used to repay all or part of the OAS pensions received by higher-income pensioners. An individual is regarded as tax resident if he meets any of the following conditions ie.

Countries are sorted by nominal GDP estimates from financial and statistical institutions which are calculated at market or government official exchange ratesNominal GDP does not take into account differences in the cost of living in different countries and the. Deductions are deductible from gross income from business only c. On the First 5000.

On the First 5000. There are no other local state or provincial. By doing so you may receive a refund for some or.

115-97 moved the United States from a worldwide system of taxation towards a territorial system of taxation. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. Disposable Personal Income in the United States increased to 1866833 USD Billion in August from 1860071 USD Billion in July of 2022.

Resident company with paid-up capital of RM25 million and below at the beginning of the basis period SME Note 1. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021. This page provides - United Kingdom Personal Income Tax Rate - actual values historical data forecast chart statistics.

On the First 5000 Next 15000. The system is thus based on the taxpayers ability to pay. Vehicle insurance also known as car insurance motor insurance or auto insurance is insurance for cars trucks motorcycles and other road vehiclesIts primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle.

Malaysia Personal Income Tax Rate. However under sections 216 2161 217 and 2183 of the Income Tax Act you have the option of filing a Canadian tax return and paying tax on certain types of Canadian-source income using an alternative tax method. Disposable Personal Income in the United States averaged 596313 USD Billion from 1959 until 2022 reaching an all time high of 2182663 USD Billion in March of 2021 and a record low of 35154 USD Billion in January of 1959.

77580 for the 2019 tax year. Income tax deduction implies lowering tax liability to the extent of interest rate paid for the mortgage loan. CIT rate 201819 and 201920.

In Malaysia for at least 182 days in a calendar year. The resident taxpayers are divided into three categories based on an individuals age. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

Personal exemptions are deductible from compensation income but a negative compensation. The income tax slab is a slab under which an individual fall is determined based on the income earned by an individual. Among other things PL.

Individuals whose income is less than Rs25 lakh per annum are exempted from tax. Personal Income Tax Rate in Sweden averaged 5542 percent from 1995 until 2022 reaching an all time high of 6140 percent in 1996 and a record low of 3230 percent in 2020. If a Malaysian or foreign national knowledge worker resides in the Iskandar Development Region and is employed in certain qualifying activities by a designated company and if their employment commences on or after 24 October 2009 but not later than 31 December.

A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia.

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

What Are The Sources Of Revenue For The Federal Government Tax Policy Center

Corporate Tax Rates By Country Corporate Tax Trends Tax Foundation

Individual Income Taxes Urban Institute

The State Of The Nation Finding Room To Lighten The Middle Income Tax Burden The Edge Markets

Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Taiwan Tax Faq Foreigners In Taiwan 外國人在臺灣

Income Tax Formula Excel University

Malaysia Personal Income Tax Guide 2020 Ya 2019

Norway Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Comments

Post a Comment